How does the Federal Reserve rate hike affect Wake County? The Federal Reserve continues to raise interest rates to fight the ongoing inflation. The federal funds rate was raised by 75 basis points again at its September meeting. In addition to raising the rates, the FED also set its “terminal rate” at 4.6% in 2023. That means the highest the federal funds rate will go is 4.6%. The current rate is between 3.0% and 3.25%.

Federal Reserve chairman Jerome Powell has made it clear that he would like to see an inflation rate of only 2% annually. That is a significant ask in a market where the current inflation has been hovering in the sevens and eights depending on what month data is extracted.

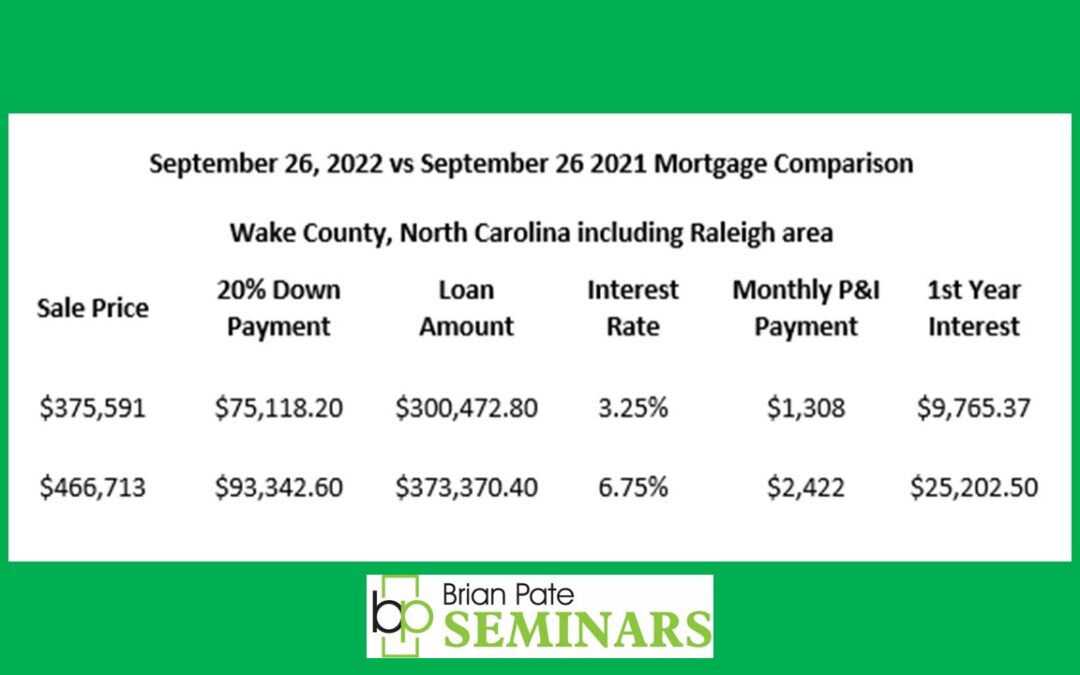

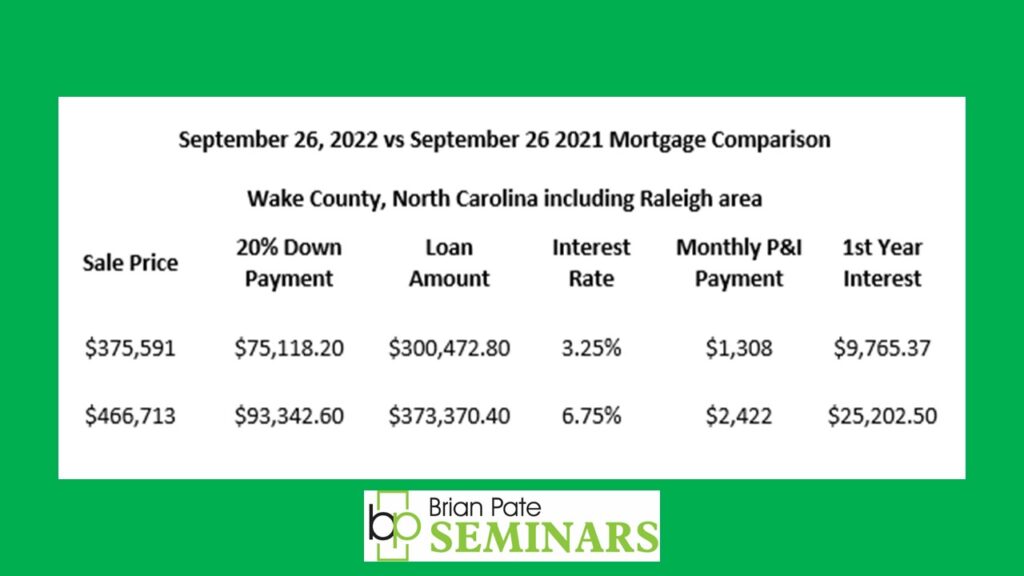

As of September 26, 2022, the average mortgage rate for a 30-year fixed rate mortgage is 6.75% nationally. That means rates have more than doubled since March 15, 2022 when rates were still in the low threes.

As we watch this process with rates, we must also look at the resulting trends in the real estate market. The number of current, active listings in the Triangle Multiple Listing Service (TMLS) is over 6,100 listings. That is up 478% since March 15, 2022.

The biggest reaction to the rising rates and inventory numbers is coming in the higher priced listings. There are over 1,070 active listings in TMLS above $700,000.

Of the 324 listings over $700,000 list price that have closed in the last 30 days, only 89 of them are new construction. That means that more than 2/3 of closed listings above $700,000 are resale listings. That is more than a three-month supply in a market that six months ago was being counted in weeks rather than months.

First time home buyers are also feeling the pain. Combine the inflation they have been dealing with for the last year and add in the massive increase in home values over the last 12 months (home prices are still up over 15% from one year ago) and buyers are better off getting into something rather than sitting on the sideline trying to save up.

In 2021, the median household income in Wake County (Raleigh area) was $83,567. The average increase in median sale price in that same area jumped from $375,591 to $466,713, a difference of $91,122. That means that a buyer that wanted to save more for a down payment, lost over $90,000 by waiting.

Take that $90,000 and add on the extra 3.5% in interest, and the mortgage will cost more than $1,100 per month more than the same house one year ago.

Buyers that continue to sit on the sidelines are costing themselves more than a year of median household income and increasing their payment by $1,100 or more.

The cost of the interest alone in the first year is over $15,000 more because of the combination of the price increase and interest rate hike.

Bottom Line:

Don’t sit on the sideline. Find a house that you can live with and get into it rather than continuing to sit on the sidelines.