Have you ever tried to decipher all of the different terms that Realtors use? In an attempt to clarify the difference between “Price Deceleration” and “Price Depreciation,” I would like to talk about the current real estate market.

To do this, I need to define a couple of terms:

Appreciation- This is when home prices INCREASE

Depreciation- This is when home prices DECREASE

Deceleration- This is when home prices appreciate, but at a slower pace

As you know, home prices the past two years have had massive gains. Did you know that homes were actually appreciating at an accelerated pace for almost 8 years before that?

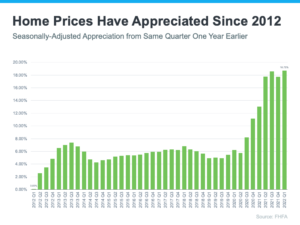

Nationally, home prices have a median annual appreciation between 3.6% and 3.9% depending on which source you use for research. That pace is considered “normal,” as opposed to what we have seen the past couple of years. As you can see from the graph below, we have beaten that average nationally every quarter since Q4 2012.

The graph below shows that home values have gained consistently over the last 10 years. However, since 2020, the growth of a home’s value has accelerated for simple reasons of supply and demand. Because supply was low and demand was high, prices skyrocketed to levels never seen before.

Buyers and sellers in today’s market want to know if the pace will continue, or if we will see prices decrease since the FED raised interest rates by .75% on Wednesday June 15, 2022.

The good news for both is that we do not expect home values to go down because inventory levels are only slightly higher than they were 4 months ago. If you are waiting on the sidelines for home prices or interest rates to drop, that decision will end up costing you tens of thousands of dollars in the long run.

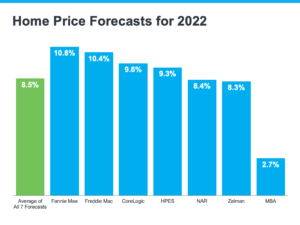

Although home prices won’t accelerate at the paces from the past two years, the expectation, even from the most cautious views are higher than the 40-year average.

On average, the expectation is an appreciation rate of 8.5%. To turn that into dollars, a home that is valued at $400,000 today is expected to be $434,000 by this same time next year.

In addition, the increase in interest rates in the past 3 months mean that a buyer would pay approximately $500 per month more for the same payment today than three months ago. Add that up over 360 payments for a 30 year loan, and that is costing $180,000 assuming all payments are made.

That is a total loss of $214,000 by waiting one year to buy a home.

The bottom line is that experts are forecasting a deceleration in home values, not depreciation. If you want to buy a home, do it now or you could find yourself priced out of that same home one year from now.