Do you remember in the movie, “Dirty Dancing,” where Johnny Castle (played by Patrick Swayze) told Baby (played by Jennifer Grey), “This is my dance space, this is your dance space; you don’t go into mine and I don’t go into yours?” This is a great way to think of a survey.

A survey completed by a professional will do the following:

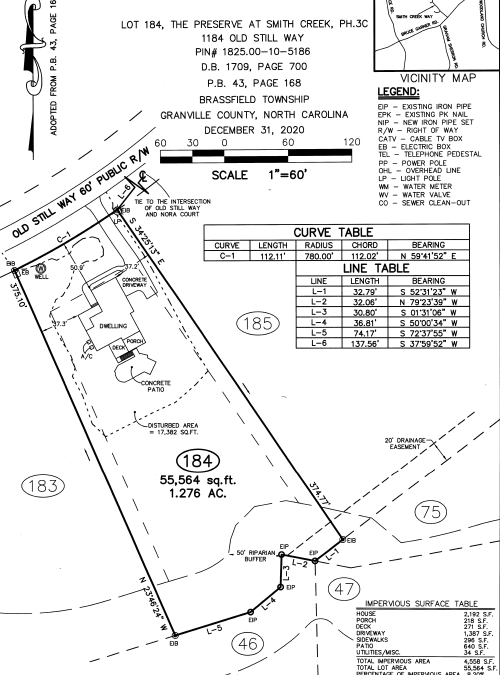

- Find the property corners set by stakes and identify the property lines with flags

- Find the accurate lot size of the piece of land

- Give a graphic representation of the property known as the “plat.”

- Identify encroachments of neighboring properties like fences and driveways over the property lines.

- Identify all easements on the property including utility and private easements

- Identify impervious surface percentages

- Identify any right of ways that others may have on the property.

In other words, the survey establishes the boundaries of your property, or “your dance space.”

It is a good idea for Buyer Agents to always recommend a survey. Without the survey, Buyers are taking many risks that can cost you dearly. Here are the top 5 reasons for getting a survey on your new home:

- Buyers might be saving money at the closing, but could be costing themselves thousands in legal disputes should an issue arise at a later time.

- Many buyers think that the title insurance will cover anything that is incorrect. In most situations, that is not the case unless there is a survey completed prior to purchase and any issues remedied.

- Don’t assume that details from an existing survey are correct. In addition, NEVER trust the source when it is the seller or listing agent. It is the responsibility of the buyer to verify details about the property.

- Don’t assume that all existing easements are known. I had an example where an easement for a new construction home wasn’t going to be recorded until closing and it was not on the current plat map. It almost caused the termination of the transaction.

- The survey also will identify if the house is in a flood plain. Normal insurance does not cover flood damage. If the house a Buyer is purchasing is in a flood zone, the Buyer will want the flood insurance as extra coverage.

In addition to getting a survey during the Due Diligence period (inspection period), it is also a good idea to get a survey updated if an owner is doing improvements like building a driveway, fence or wall. In many cases, homeowners associations will require a copy of the survey when applying for approval from an architectural review committee.